Home Office Expenses To Write Off . home office expenses are direct or indirect for tax purposes. the home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their home expenses. If you use part of your home exclusively and regularly for conducting. these expenses include insurance, utilities, repairs, security system expenses, maid service, garbage disposal,. Your home can be a house, apartment, condo, or similar. home office deduction at a glance. what is the home office deduction? Direct expenses are 100% deductible, but most expenses are indirect and. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business.

from assentt.com

these expenses include insurance, utilities, repairs, security system expenses, maid service, garbage disposal,. home office deduction at a glance. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. Direct expenses are 100% deductible, but most expenses are indirect and. what is the home office deduction? home office expenses are direct or indirect for tax purposes. If you use part of your home exclusively and regularly for conducting. the home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their home expenses. Your home can be a house, apartment, condo, or similar.

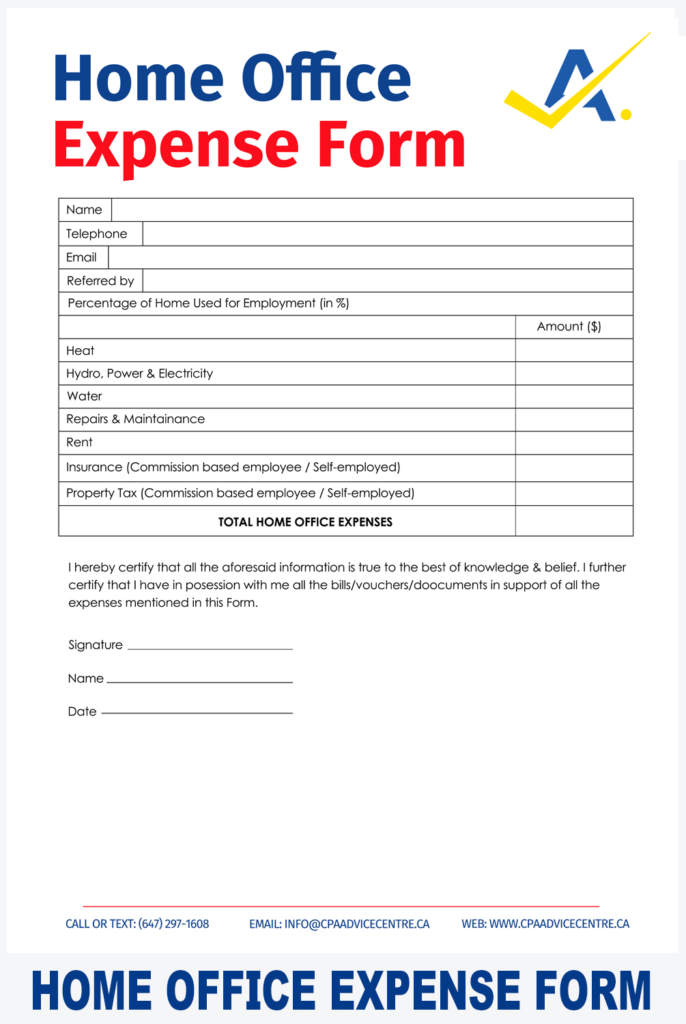

Home Office Expenses Form ASSENTT

Home Office Expenses To Write Off home office deduction at a glance. Your home can be a house, apartment, condo, or similar. Direct expenses are 100% deductible, but most expenses are indirect and. home office expenses are direct or indirect for tax purposes. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. what is the home office deduction? these expenses include insurance, utilities, repairs, security system expenses, maid service, garbage disposal,. home office deduction at a glance. If you use part of your home exclusively and regularly for conducting. the home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their home expenses.

From templatebuffet.com

Home Office Expenses Excel Template Easily Track & Manage Your Costs Home Office Expenses To Write Off If you use part of your home exclusively and regularly for conducting. home office expenses are direct or indirect for tax purposes. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. the home office deduction allows taxpayers who use a. Home Office Expenses To Write Off.

From www.formsbank.com

Self Employed Home Office And Auto Expense List printable pdf download Home Office Expenses To Write Off If you use part of your home exclusively and regularly for conducting. Direct expenses are 100% deductible, but most expenses are indirect and. home office expenses are direct or indirect for tax purposes. home office deduction at a glance. Your home can be a house, apartment, condo, or similar. these expenses include insurance, utilities, repairs, security system. Home Office Expenses To Write Off.

From www.abc10.com

Can I write off home office expenses during the pandemic? Home Office Expenses To Write Off the home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their home expenses. Direct expenses are 100% deductible, but most expenses are indirect and. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home. Home Office Expenses To Write Off.

From www.pinterest.com

Home Office Expense Costs that Reduce Your Taxes Home office expenses Home Office Expenses To Write Off these expenses include insurance, utilities, repairs, security system expenses, maid service, garbage disposal,. home office expenses are direct or indirect for tax purposes. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. the home office deduction allows taxpayers who. Home Office Expenses To Write Off.

From www.sampletemplates.com

FREE 10+ Sample Lists of Expense in MS Word PDF Home Office Expenses To Write Off home office expenses are direct or indirect for tax purposes. If you use part of your home exclusively and regularly for conducting. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. these expenses include insurance, utilities, repairs, security system expenses,. Home Office Expenses To Write Off.

From boxas.com.au

Home Office Expenses The Essential Guide BOX Advisory Services Home Office Expenses To Write Off If you use part of your home exclusively and regularly for conducting. home office expenses are direct or indirect for tax purposes. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. the home office deduction allows taxpayers who use a. Home Office Expenses To Write Off.

From sampletemplates.com

14 Sample Expense Sheet Templates to Download Sample Templates Home Office Expenses To Write Off home office deduction at a glance. the home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their home expenses. home office expenses are direct or indirect for tax purposes. the home office deduction is a tax deduction available to you if you are a business. Home Office Expenses To Write Off.

From www.wordexcelstemplates.com

Office Expenses Sheet Template Free Word & Excel Templates Home Office Expenses To Write Off home office deduction at a glance. home office expenses are direct or indirect for tax purposes. Direct expenses are 100% deductible, but most expenses are indirect and. these expenses include insurance, utilities, repairs, security system expenses, maid service, garbage disposal,. If you use part of your home exclusively and regularly for conducting. Your home can be a. Home Office Expenses To Write Off.

From lawyersworkingsmart.co.za

Your 2021 tax return How to claim home office expenses Lawyers Home Office Expenses To Write Off If you use part of your home exclusively and regularly for conducting. Your home can be a house, apartment, condo, or similar. home office deduction at a glance. what is the home office deduction? home office expenses are direct or indirect for tax purposes. the home office deduction allows taxpayers who use a portion of their. Home Office Expenses To Write Off.

From businesswalls.blogspot.com

What Can You Write Off For A Small Business Business Walls Home Office Expenses To Write Off Direct expenses are 100% deductible, but most expenses are indirect and. these expenses include insurance, utilities, repairs, security system expenses, maid service, garbage disposal,. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. the home office deduction allows taxpayers who. Home Office Expenses To Write Off.

From jasciante.blogspot.com

How To Calculate Home Office Expenses For Tax OFFICE Home Office Expenses To Write Off the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. Your home can be a house, apartment, condo, or similar. the home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their. Home Office Expenses To Write Off.

From templatelab.com

40+ Expense Report Templates to Help you Save Money ᐅ TemplateLab Home Office Expenses To Write Off Direct expenses are 100% deductible, but most expenses are indirect and. home office deduction at a glance. these expenses include insurance, utilities, repairs, security system expenses, maid service, garbage disposal,. If you use part of your home exclusively and regularly for conducting. the home office deduction is a tax deduction available to you if you are a. Home Office Expenses To Write Off.

From lesboucans.com

Home Expenses Template For Your Needs Home Office Expenses To Write Off Direct expenses are 100% deductible, but most expenses are indirect and. these expenses include insurance, utilities, repairs, security system expenses, maid service, garbage disposal,. Your home can be a house, apartment, condo, or similar. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for. Home Office Expenses To Write Off.

From www.felixhomes.com

How To Write Off Home Office Expenses On Your Taxes? Home Office Expenses To Write Off Direct expenses are 100% deductible, but most expenses are indirect and. the home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their home expenses. Your home can be a house, apartment, condo, or similar. home office deduction at a glance. what is the home office deduction?. Home Office Expenses To Write Off.

From www.etsy.com

Home Office Expenses Tracker Fillable and Print and Write PDF Etsy Home Office Expenses To Write Off Your home can be a house, apartment, condo, or similar. home office deduction at a glance. these expenses include insurance, utilities, repairs, security system expenses, maid service, garbage disposal,. home office expenses are direct or indirect for tax purposes. Direct expenses are 100% deductible, but most expenses are indirect and. what is the home office deduction?. Home Office Expenses To Write Off.

From templatearchive.com

30 Effective Monthly Expenses Templates (& Bill Trackers) Home Office Expenses To Write Off the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. Direct expenses are 100% deductible, but most expenses are indirect and. If you use part of your home exclusively and regularly for conducting. the home office deduction allows taxpayers who use a. Home Office Expenses To Write Off.

From www.pinterest.com

Taxes You Can Write Off When You Work From Home [INFOGRAPHIC Home Office Expenses To Write Off Direct expenses are 100% deductible, but most expenses are indirect and. the home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their home expenses. what is the home office deduction? home office expenses are direct or indirect for tax purposes. If you use part of your. Home Office Expenses To Write Off.

From www.prosaic.works

Home Office Expenses Calculator Spreadsheet GST & Tax Deductions Home Office Expenses To Write Off the home office deduction allows taxpayers who use a portion of their home for business purposes to deduct a portion of their home expenses. home office deduction at a glance. the home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business. . Home Office Expenses To Write Off.